Get the right experience for you. Please select your location and investor type.

Pacific Assets Trust plc

Launched in 1985, the Pacific Assets Trust plc invests in companies in the Asia Pacific and Indian Subcontinent regions. The Trust’s portfolio is managed by Stewart Investors.

- About the Trust

- Portfolio Explorer

- Quarterly update

- Insights

- Literature

- Price and performance

- SFDR disclosures

- How to invest

- Contact us

The aim of the Trust is to achieve long-term capital growth through investment in selected companies in the Asia Pacific region and Indian Subcontinent. Excluding Japan, Australia and New Zealand. Stewart Investors believes the best way to achieve that aim is by investing in high-quality businesses that contribute to, and benefit from, sustainable development. Companies that combine these attributes are particularly well-positioned to generate long-term returns and deliver positive social and environmental outcomes.

The Board of Directors

The Trust is overseen by a Board of Directors that is independent of the portfolio manager, Stewart Investors. The six members of the Board are accountable for the governance and wellbeing of the company, and meet on a regular basis to ensure the objectives of the Trust continue to be met.

The Directors have extensive and varied experience and you can learn more about them here.

PortfolioA portfolio is a collection of investments. In the case of Pacific Assets Trust, it’s all of the companies the trust invests in, together with any cash in its bank account. Management Team

Stewart Investors have been the Trust’s PortfolioA portfolio is a collection of investments. In the case of Pacific Assets Trust, it’s all of the companies the trust invests in, together with any cash in its bank account. Manager since July 2010. Stewart Investors adopts a sustainable investment strategy when selecting the Trust’s investments. Stewart Investors has been investing in the Asia Pacific region for more than three decades and believes that fully incorporating sustainability into its investment process is the best way to protect and grow investors’ money over the long term.

Sustainable investing can mean many things to different people, but at Stewart Investors, the approach focuses on finding high-quality companies run by excellent management teams, that are well-positioned to contribute to, and benefit from, sustainable development.

With the support of the wider investment team, David Gait and Douglas Ledingham are the portfolioA portfolio is a collection of investments. In the case of Pacific Assets Trust, it’s all of the companies the trust invests in, together with any cash in its bank account. managers for the Trust. You can find out more about the team and learn more about Stewart Investors’ investment approach here.

Latest updates on the Trust

Portfolio Explorer

This interactive tool allows you to explore the companies that the Trust invests in, and discover the contributions they are making to sustainable development.

* This video may contain companies not held in the Trust, it is for illustration purposes only.

Portfolio Explorer tells the stories of the companies the Trust invests in. The company profiles have been written by the investment team so that you can see why they believe that the companies they invest in are making the world a better place.

If you are unable to view the portfolio explorer, please re-open in Google Chrome, Edge, Firefox, Safari or Opera. IE11 is not supported.

For illustrative purposes only. Reference to the names of example company names mentioned in this communication is merely for explaining the investment strategy and should not be construed as investment advice or investment recommendation of those companies. Companies mentioned herein may or may not form part of the holdings of Stewart Investors. Holdings are subject to change.

Certain statements, estimates, and projections in this document may be forward-looking statements. These forward-looking statements are based upon Stewart Investors’ current assumptions and beliefs, in light of currently available information, but involve known and unknown risks and uncertainties. Actual actions or results may differ materially from those discussed. Readers are cautioned not to place undue reliance on these forward-looking statements. There is no certainty that current conditions will last, and Stewart Investors undertakes no obligation to correct, revise or update information herein, whether as a result of new information, future events or otherwise.

Source: Stewart Investors investment team and company data. Securities mentioned are all investee companies* for the Pacific Assets Trust plc as at 31 December 2023. *Assets that the Trust may hold which an active decision has not been made, and sustainability assessment does not apply, include cash, cash equivalents, short-term holdings for the purpose of efficient portfolio management and holdings received as a result of mandatory corporate actions. Holdings of such assets will not appear on Portfolio Explorer.

Stewart Investors supports the Sustainable Development Goals (SDGs). The full list of SDGs can be found on the United Nations website.

Source for Climate Solutions and impact figures: © 2014–2024 Project Drawdown (drawdown.org). Source for Human Development Pillars: Stewart Investors investment team.

Source for climate solutions and human development analysis and mapping: Stewart Investors investment team. Contributions are defined by the team as demonstrable contributions to any solution, either direct (directly attributable to products, services or practices provided by that company) or enabling (supported or made possible by products or technologies provided by that company).

Investment terms

View our list of investment terms to help you understand the terminology within this document.

Our quarterly updates summarise key activity over the previous quarter, for example any new companies that have been bought or sold and the reasons why. There is also detail on how the Portfolio Manager has voted on behalf of the Trust.

Q4 2023

Significant Trust changes

Over most three-month periods, there should be relatively little change in the Trust portfolio. We aim to invest in high-quality companies with diverse income sources that have the ability to grow in value over the long term. High-quality companies at reasonable valuations tend not to come along too often. In the absence of such opportunities, we are very comfortable long-term owners of companies in the portfolio.

During the quarter we initiated three new positions in Samsung Biologics (South Korea: Health Care), Wuxi Biologics (China: Health Care) and RBL Bank (India: Financials). We have admired the Samsung Biologics franchise for many years. They have expanded production capacity quickly and efficiently which has helped them increase spending from existing clients and to win important new clients. Our more constructive stance on governance at the Samsung Group was another important consideration. We have also been studying Wuxi Biologics for a number of years. It is a leading contract research provider and manufacturer for pharmaceutical companies. The businesses stewards have spent the last decade nurturing strong relationships with customers across geographies, and are building on their research relationships to scale up manufacturing services. The nature of the business, where the timeline from drug discovery to manufacturing can be decades, means that long-term customer relationships are crucial, and the trust built is difficult to disrupt. RBL Bank is a full-service bank that provides services to over 13 million customers across India. Under a new and reinvigorated management team, RBL is in early stages of building a high-quality lending institution. In terms of additions we added to holdings in Midea (China: Consumer Discretionary), the largest home appliances business in China and Triveni Turbines (India: Industrials), a market leader in the manufacture, maintenance and refurbishment of steam turbines.

There were no divestments during the period. We trimmed Tata Consumer Products (India: Consumer Staples), Tech Mahindra (India: Information Technology) and CG Power (India: Industrials) to control position size.

Investment objective

The investment objective of the Trust is to achieve long-term capital growth through investment in selected companies in the Asia Pacific region and the Indian Subcontinent, but excluding Japan, Australia and New Zealand (the ‘Asia Pacific Region’). Up to a maximum of 20% of the Trust’s total assets (at the time of investment) may be invested in companies incorporated and/or listed outside the Asia Pacific Region (as defined); at least 25% of their economic activities (at the time of investment) are within the Asia Pacific Region and this proportion is expected to grow significantly over the longer term.

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Named new investments disclosed relate to holdings with a portfolio weight over 0.5%. It is not a recommendation or solicitation to purchase or invest in any fund. Differences between the representative account-specific constraints, currency or fees and those of a similarly managed fund or mandate would affect results.

As active investors and long-term shareholders, we vote on all proposals at annual and extraordinary general meetings of the companies we invest in. This is how we’ve voted over the quarter.

Proxy voting: 1 October - 31 December 2023

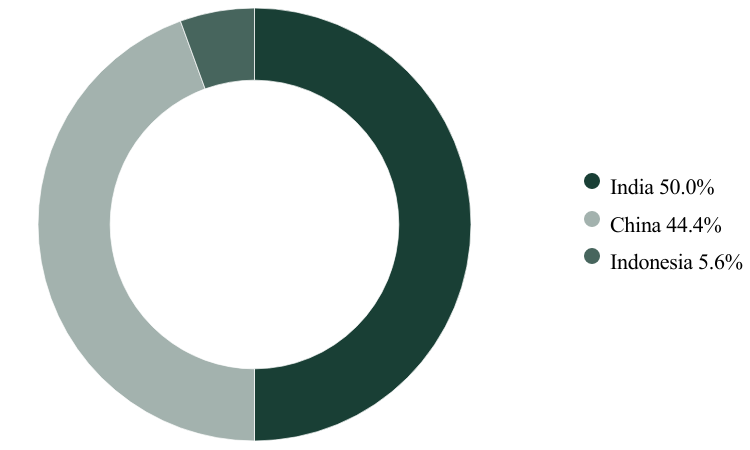

Proxy voting by country of origin

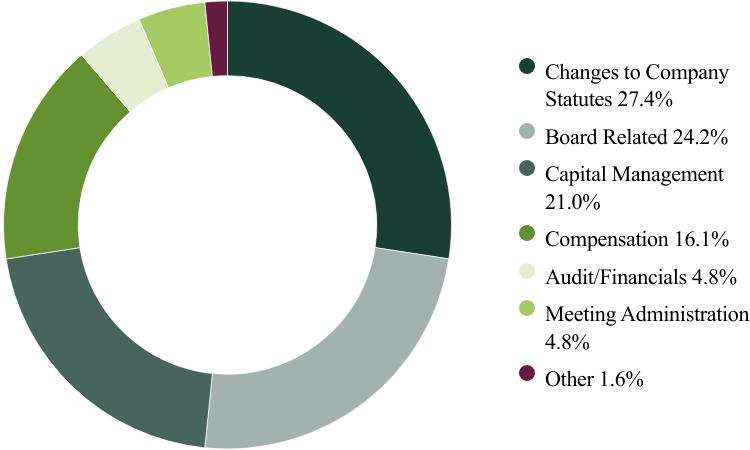

Proxy voting by proposal categories

During the quarter there were 62 resolutions from 14 companies to vote on. On behalf of the Trust, we did not vote against any resolutions.

We abstained from voting on the approval of a renewed liability insurance for Directors, Supervisors, and Senior Management at Midea Group as we did not have sufficient information on the details of the insurance policy at the time of voting. (one resolution)

Source for company information: Stewart Investors investment team and company data. This stock information does not constitute any offer or inducement to enter into any investment activity. Portfolio data shown is from representative strategy accounts of the strategy shown above. Proxy voting chart numbers may not add to 100 due to rounding. SHP means: Shareholder Proposal.

Download a PDF copy

Select Strategy update and/or Proxy voting to produce a report. You can then download a copy of the report by clicking on the button.

Other Trust news

Key updates from the Trust

Previous monthly factsheets and Quarterly shareholder updates can be found on the Literature section.

Annual General Meeting 2023 - Shareholder update from Doug Ledingham

Trust Literature

- March 2024 Factsheet

- February 2024 Factsheet

- January 2024 Factsheet

- December 2023 Factsheet

- November 2023 Factsheet

- October 2023 Factsheet

- September 2023 Factsheet

- August 2023 Factsheet

- July 2023 Factsheet

- June 2023 Factsheet

- May 2023 Factsheet

- April 2023 Factsheet

- March 2023 Factsheet

- February 2023 Factsheet

- January 2023 Factsheet

- December 2022 Factsheet

- November 2022 Factsheet

- October 2022 Factsheet

- September 2022 Factsheet

- August 2022 Factsheet

- July 2022 Factsheet

- June 2022 Factsheet

- May 2022 Factsheet

- April 2022 Factsheet

- Half year report to July 2023

- *Annual report 2023

- Half year report to July 2022

- Annual report 2022

- Half year report to July 2021

- Annual report 2021

- Half year report to July 2020

- Annual report 2020

- Half year report to July 2019

- Annual report 2019

- Half year report to July 2018

- Annual report 2018

- Half year report to July 2017

- Annual report 2017

- Half year report to July 2016

- Annual report 2016

- Half year report to 31 July 2015

- Annual report 2015

- Half year report to 31 July 2014

- Annual report 2014

- Half year report to 31 July 2013

- Annual report 2013

- Half year report to 31 July 2012

- Annual report 2012

- Half year report to 31 July 2011

- Annual report 2011

- Half year report to 31 July 2010

- Annual report 2010

- Half year report to 31 March 2009

- Annual report 2009

Sustainable Finance Disclosure Regulation (SFDR)

Shareholder information

Investor documents

- Investor Disclosure Document

- Key Information Document (UK)

- Key Information Document (EU)

- Past performance (EU PRIIPS requirement)

Recent regulatory news

Recent regulatory news and releases about Pacific Assets Trusts plc can be found on the London Stock Exchange (LSE) site here. By clicking on the regulatory news service (RNS) link above you will be leaving the Stewart Investors website. Pacific Assets Trust plc is not responsible for the content of any linked website.

- June 2023 - AGM Proxy Votes

- June 2022 - AGM Proxy Votes

- June 2021 - AGM Proxy Votes

- June 2020 - AGM Proxy Votes

- June 2019 - AGM Proxy Votes

- June 2018 - AGM Proxy Votes

- June 2017 - AGM Proxy Votes

- June 2016 - AGM Proxy Votes

- June 2015 - AGM Proxy Votes

- June 2014 - AGM Proxy Votes

- June 2013 - AGM Proxy Votes

- June 2012 - AGM Proxy Votes

- June 2011 - AGM Proxy Votes

- June 2010 - AGM Proxy Votes

Providers, policies and statements

Company policies

Important dates

- September 2023 - Half Year Results Announced

- 31 July 2023 - Half Year End

- 3 July 2023 - Annual General Meeting

- July 2023 - Dividend Payable

- May 2023 - Final Results Announced

- 31 January 2023 – Financial Year End

- July 2022 - Dividend Payable

- 31 July 2022 - Half Year End

- September 2022 - Half Year Results Announced

Principal Service Providers and Auditors

- First Sentier Investors (UK) IM Limited, trading as Stewart Investors - Portfolio Manager

- Frostrow Capital LLP - Alternative Investment Fund Manager, Company Secretary and Administrator

- JP Morgan Chase Bank - Custodian

- Equiniti Limited - Registrar

- BDO LLP - Auditor

- Investec Bank plc – Broker

Some of these documents contain information which is no longer up to date. As such, they are maintained on the website solely for informational purposes to provide historical information. The documents should not be relied upon, including for the purposes of an investment decision. Stewart Investors recommend that you seek professional investment advice before making a decision to invest in any fund.

Latest price and performance

The value of investments and any income from them may go down as well as up and you or your client may not get back the amount originally invested.

Please see below for definitions of the terms in these tables.

| Period | 12 months to 31/03/24 | 12 months to 31/03/23 | 12 months to 31/03/22 | 12 months to 31/03/21 | 12 months to 31/03/20 |

|---|---|---|---|---|---|

| Nav% | 7.0 | 5.5 | 4.5 | 47.1 | -16.4 |

| Share Price | -0.2 | 12.7 | 1.1 | 48.3 | -25.9 |

| CPI + 6%*** | 9.8 | 17.2 | 12.7 | 6.6 | 8.0 |

| Peer Group Return | -0.5 | -4.5 | -7.3 | 68.1 | -12.8 |

| MSCI AC Asia ex Japan Net Index** | 1.8 | -3.0 | -10.6 | 41.4 | -9.0 |

| Period | Since Inception | 10 yrs | 5 yrs | 3 yrs | 1 yr | 6 mths | 3 mths |

|---|---|---|---|---|---|---|---|

| NAV% | 284.5 | 174.4 | 45.0 | 18.0 | 7.0 | 1.7 | 1.1 |

| Share Price | 269.5 | 161.0 | 25.0 | 13.7 | -0.2 | -5.6 | -8.8 |

| CPI + 6%*** | 234.2 | 141.5 | 66.8 | 44.9 | 9.8 | 3.7 | 1.9 |

| Peer Group Return | 211.6 | 154.4 | 28.6 | -12.0 | -0.5 | 3.7 | 0.1 |

| MSCI AC Asia ex Japan Net Index** | 129.3 | 98.7 | 13.6 | -11.7 | 1.8 | 5.3 | 3.3 |

| Ex Div | Record Date | Pay Date | Typeǂ | Pence/Share |

|---|---|---|---|---|

| 8 June 2023 | 9 June 2023 | 6 July 2023 | Final | 2.3 |

| 9 June 2022 | 10 June 2022 | 1 July 2022 | Final | 1.9 |

| 13 May 2022 | 14 May 2022 | 5 July 2022 | Final | 2.4 |

| 28 May 2020 | 29 May 2020 | 2 July 2020 | Interimǂǂ | 3.0 |

| 30 May 2019 | 31 May 2019 | 4 July 2019 | Final | 3.0 |

| 31 May 2018 | 1 June 2018 | 4 July 2018 | Final | 2.6 |

| 1 June 2017 | 2 June 2017 | 4 July 2017 | Final | 2.6 |

| 2 June 2016 | 3 June 2016 | 4 July 2016 | Final | 2.2 |

| 28 May 2015 | 29 May 2015 | 29 June 2015 | Final | 2.6 |

| 28 May 2014 | 30 May 2014 | 27 June 2014 | Final | 2.6 |

| 29 May 2013 | 31 May 2013 | 28 June 2013 | Final | 2.6 |

| 30 May 2012 | 1 June 2012 | 29 June 2012 | Final | 2.6 |

| 1 June 2011 | 3 June 2011 | 30 June 2011 | Final | 1.29 |

| 2 June 2010 | 4 June 2010 | 30 June 2010 | Final | 1.29 |

| 20 May 2009 | 22 May 2009 | 19 June 2009 | Final | 1.29 |

Glossary

Discreet performance: This is the performance over a specific time-period. In this case, it’s over one year up until the date shown, annually. This performance is shown net of fees, which means after any fees have been deducted.

Cumulative performance: This is the performance of the Trust over the time periods shown in the table. This performance is shown net of fees, which means after any fees have been deducted.

NAV%: Net asset value is the total value of all of the Trust’s investments and cash, less any debts or loans.

CPI+6%: The trust’s performance objective against which the Portfolio Manager’s performance is measured is to provide shareholders with greater than the UK Consumer Price Index (CPI) plus 6%. CPI is a measurement of price changes for consumers. The additional 6% is what the Board considers to be a reasonable increase from investing in the faster-growing Asian economies over the long term.

Peer Group ReturnThe Board also monitors the Company’s performance against its peer group of five other investment trusts with similar investment mandates and one exchange traded fund (“ETF”). It is a subset of the Association of Investment Companies peer group, considered by the board as those whose investment policies are substantially similar to those of the Trust

MSCI AC Asia ex Japan Index: An index is a collection of investments designed to replicate the performance of a region or a specific market. Investors can use this one as a way of comparing the Trust’s performance because it is the closest geographically to the countries in which the Trust invests.

Dividends: This is a payment made to the Trust’s shareholders.

Net-Asset-Value (NAV): This is the value of the all the Trust’s investments and cash minus its debts.

Net-Asset-Value (NAV) per share: This is the value of the Trust expressed per share. It is calculated by dividing the NAV by its shares outstanding.

Cum Income NAV Per Share (p): This reflects the NAV per share including the income the Trust has received in the current financial year.

Cum Income Discount / Premium (%): This is the percentage difference between the share price and the Cum Income Nav Per Share. A positive difference means that the share price is trading at a premium and negative percentage difference means that the share price is trading at a discount over its NAV including income.

Ex-Income NAV Per Share (p): This reflects the NAV Per Share excluding the income the Trust has received in the current financial year.

Ex-Income Discount / Premium (%): This is the percentage difference between the share price and the Ex-Income NAV Per Share. A positive difference means that the share price is trading at a premium (over its NAV excluding income) and a negative percentage difference means that the share price is trading at a discount to its NAV excluding income.

Ex Div or Ex-dividend: This means that the share price of the Trust is trading without the value of the next dividend payment.

Important information

This document is a financial promotion for Pacific Assets Trust plc (the “Trust”) only for those people resident in the UK for tax and investment purposes. Investing involves certain risks including:

- The value of investments and any income from them may go down as well as up and are not guaranteed. Investors may get back significantly less than the original amount invested.

- Emerging market risk: emerging markets may not provide the same level of investor protection as a developed market; they may involve a higher risk than investing in developed markets.

- Currency risk: the Trust invests in assets which are denominated in currencies other than pound sterling; changes in exchange rates will affect the value of the Trust.

- The Trust’s share price may not fully reflect net asset value.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell. Reference to the names of any company is merely to explain the investment strategy and should not be construed as investment advice or a recommendation to invest in any of those companies.

For an overview of the terms of investment, risks, returns and costs and charges please refer to the Key Information Document which can be found on this website. If you are in any doubt as to the suitability of the Trust for your investment needs, please seek investment advice.

Past performance is not a reliable indicator of future results.

Although the Company will use the MSCI AC Asia ex Japan Index and CPI +6% as comparator indices, these indices will not be used for portfolio construction or risk management purposes.

These figures refer to the past. Past performance is not a reliable indicator of future results. For investors based in countries with currencies other than GBP, the return may increase or decrease as a result of currency fluctuations. The NAV performance data is on a net basis after deducting all fees (e.g. investment management fee) and costs (e.g. transaction and custody costs) incurred by the Trust. The NAV includes dividends reinvested on a net of tax basis. CPI data is quoted on a one month lag. The peer group is a subset of the Association of Investment Companies peer group, considered by the board as those whose investment policies are substantially similar to those of the Trust. Peer group performance is determined on a simple average share price basis by measuring percentage growth over the period using bid prices, on the basis that net income is reinvested in Sterling. The comparator shown is the MSCI AC Asia ex Japan Index, on an income reinvested net of tax basis. Sources: i) Lipper for Trust and peer group share prices returns; ii) Trust Administrator and Bloomberg for NAV performance data; iii) CPI data is sourced from Factset.

* Performance since Stewart Investors was appointed as Investment Manager with effect from the 1st July 2010.

** The MSCI AC Asia ex Japan Index is shown here as a comparator to provide additional context for investors seeking exposure to the region.

*** The Performance Objective is considered to be appropriate given the Investment Manager’s index agnostic investment philosophy and will not change its style or strategy, or the make-up of the portfolio.

ǂ A Final Dividend is a dividend declared by the Board of Directors after the company has issued its annual financial statements.

ǂǂ In light of the response to the coronavirus pandemic in 2020 the board decided to declare an interim dividend rather than a final dividend. Declaring an interim dividend means that shareholders would be paid a dividend irrespective of whether the AGM was able to proceed as planned. Please see annual report for further details.

SFDR disclosures for Article 9

This information relates to Pacific Assets Trust plc (the “Trust”)

What is SFDR?

SFDR stands for the Sustainable Finance Disclosure Regulation. It is a regulation that provides more transparency for investors in relation to sustainability risks. Investment trusts, such as the Trust, need to provide information around sustainability, allowing investors to make more informed decisions.

What is Article 9?

Article 9 funds are those with a clearly defined sustainable investment objective. This means they must make only sustainable investments and explain how these investments are sustainable. You can learn more about SDFR and Article 9 here.

Sustainable investment objective

Companies can contribute in many different ways to a better future for people and planet. The Portfolio Manager provides descriptions on how they believe each company is contributing towards sustainable development via the interactive Portfolio Explorer tool.

Users can explore the stories of individual companies organised by the diverse contributions they make including towards human development pillars and climate solutions. This information is updated on a quarterly basis.

The Trust only invests in companies that the Portfolio Manager believes are sustainable, which contribute to a social and/or environmental objective. The contribution of the Trust investments to the social and environmental objectives are assessed by reference to two framework indicators – the Portfolio Manager’s human development pillars and Project Drawdown climate change solutions.

Stewart Investors considers whether:

- there is either a direct1 or enabling2 link between the activities of the company and the achievement of a positive social or environmental outcome;

- the company can benefit from any contribution to positive social or environmental outcomes through sales or expected growth, or from the company’s strong culture e.g. diversity; and

- the company recognises potential negative outcomes associated with its product or services and works towards minimising them (e.g. a company that sells affordable nutritious food products in plastic packaging, but is investigating alternative packaging).

Positive social outcomes

The Trust will only invest in a company if Stewart Investors believe its activities lead to a positive social outcome.

Stewart Investors commits to investing in companies that it feels contribute to at least one of the following positive social outcomes which Stewart Investors call the human development pillars:

- Health and well-being – improved access to and affordability of nutrition, healthcare and hygiene, water and sanitation.

- Physical infrastructure – improved access to and affordability of energy and housing.

- Economic welfare – safe employment offering a living wage and opportunities for advancement, access to finance and improved standards of living.

- Opportunity and empowerment – improved access to and affordability of education and information technology.

Positive environmental outcomes

Stewart Investors assesses positive environmental outcomes by reference to the climate solutions developed by Project Drawdown3. Project Drawdown is a non-profit organisation that has mapped, measured and modelled over 90 different climate solutions that it believes will contribute to reaching ‘drawdown’, i.e. the future point in time when levels of greenhouse gases in the atmosphere stop climbing and start to steadily decline.

Below is a list of climate solutions, together with corresponding examples Stewart Investors believes lead to positive environmental outcomes:

- Food system – sustainable farming, food production and distribution of food-related products and services.

- Energy – adoption of renewable energy and other clean energy and related technologies.

- Circular economy and industries – improved efficiency, reduced waste e.g. recycling existing materials.

- Human development – advancement of human rights and education that drive environmental conservation and sustainable use of resources.

- Transport – efficient transport technologies and growth in fossil fuel-free transportation options.

- Buildings – products and services which reduce the environmental footprint of the built environment, including energy efficiency, electrification, improved design, and use of alternative materials.

- Water – less energy-intensive methods for treating, transporting and heating water.

- Conservation and restoration – supporting deforestation-free and environmentally friendly supply chains.

The data and charts below provide a summary of the social and environmental outcomes for the Trust. This information will be updated twice per year.

Pacific Assets Trust reporting to 31 December 2023

- As at 31 December 2023, the Trust held 67 companies.

- All companies (100%) were contributing to at least one human development pillar and, in total, were making 190 contributions to the pillars.

- 42 companies (63%) were contributing to climate change solutions. These companies were contributing to 40 different solutions and, in total, were making 134 contributions to the solutions.

The social and environmental outcomes for the Trust are provided in the charts.

Source for analysis and mapping: Stewart Investors investment team, company data and © 2014–2024 Project Drawdown (drawdown.org) as at 31 December 2023.

Contributions are defined by Stewart Investors as demonstrable contributions to any solution, either direct (directly attributable to products, services or practices provided by that company) or enabling (supported or made possible by products or technologies provided by that company). More information is available on the Portfolio Explorer.

How to invest

Shares in Pacific Assets Trust plc can be bought directly through a stockbroker or financial adviser.

There are online brokers that allow investors to trade for a small fee; we have included a list of some below. This list is not comprehensive and does not constitute any form of recommendation.

Investors can buy shares on a regular basis through saving scheme providers, which allow investors to buy any plc or investment company through their websites. Some of these are also included on the list below.

Pacific Assets Trust plc does not recommend any of these organisations in particular. Terms and costs of each provider may vary. Pacific Assets Trust plc does not provide financial or investment advice.

If you don’t have an adviser but would like financial advice, you can find an independent financial adviser at unbiased.co.uk. You may be charged for any advice you receive.

| Useful links | ||

|---|---|---|

Sharedealing – EQ Shareview

Equiniti Financial Services Limited, which is the company that manages the share register for the Trust, offers a share dealing service.

This provides a simple way for UK shareholders of Pacific Assets Trust plc to buy or sell their shares in the Trust; it is a service which is only available to people with a UK address, who are aged 18 and over.

For full details and terms and conditions visit www.shareview.co.uk/dealing or call 03456 037037 between 8.00am and 4.30pm Monday to Friday.

Equiniti Financial Services Limited’s registered office is, Aspect House, Spencer Road, Lancing, West Sussex BN99 6DA and it is registered in England and Wales with number 6208699.

Equiniti Financial Services Ltd is authorised and regulated by the Financial Conduct Authority.

Past performance is no guarantee of future performance. The value of your investment and any income from it may go down as well as up and you may not get back the amount invested. This is because the share price is determined by the changing conditions in the relevant stock markets in which the Company invests and by the supply and demand for the Company's shares. As the shares in an investment trust are traded on a stock market, the share price will fluctuate in accordance with the supply and demand and may not reflect the underlying net asset value of the shares; where the share price is less than the underlying value of the assets, the difference is known as the 'discount'. This is one of the reasons that investors may not get back the original amount invested. Although the Company's shares are denominated in sterling, it may invest in stocks and shares which are denominated in currencies other than sterling and to the extent they do so, they may be affected by movements in exchange rates. As a result the value of your investment may rise or fall with movements in exchange rates. Investors should note that tax rates and reliefs may change at any time in the future. The value of ISA tax advantages will depend on personal circumstances. The favourable tax treatments of ISAs may not be maintained.

Contact us and find out more

General enquiries

Portfolio Manager: Stewart Investors

Tel: +44 131 473 2900

[email protected]

Company Secretary:

Frostrow LLP

Tel: +44 (0) 203 0084910

[email protected]

Registrar: Equiniti Limited

Tel: 0371 383 2030

Contact Equiniti

Register for updates

Sign-up to receive regular insights on Pacific Assets Trust.